Buy now pay later, Loan & Savings

Offers a comprehensive financial solution platform that encompasses a variety of savings schemes, loan, investment

Do you have a question on this product, you ask through the comment section. Do you need a quote on this product, click here

Offers a comprehensive financial solution platform that encompasses a variety of savings schemes, an advanced loan system, Buy Now Pay Later (BNPL) options, mutual fund and equity investments, project investments, money transfers, and much more. Within the savings system, you'll find Regular Savings, Emergency Savings, Duo Savings, and Saving Circles.

Regular Savings

Regular Savings lets you save money consistently within a locked plan for a predefined period and earn interest at the plan's end. Admins have the flexibility to configure plan durations and various interest rates for these regular plans.

Emergency Savings

This option allows you to save for unforeseen emergencies and easily access your funds when needed. Monthly reminders help you stay on track to reach your savings goal. Interest is also provided, although it may be limited if annual goals aren't met, as determined by the admin.

Duo Savings

Duo Savings, also known as couple savings, is designed for couples saving toward joint goals such as a dream vacation to the Maldives. Similar to other plans, interest is offered, but its growth may be restricted if the user-defined annual goals aren't achieved.

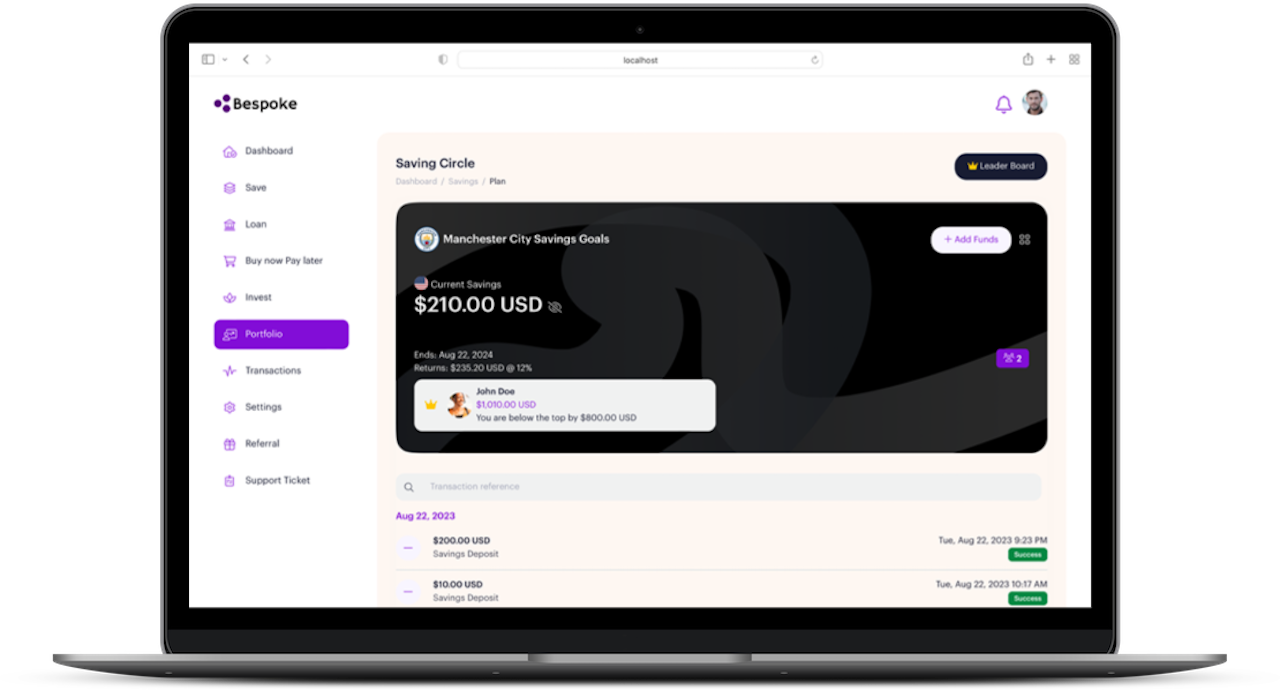

Saving Circles

Saving Circles provide an engaging way to save money. You can join circles tailored to your interests, such as Manchester United fans, Freelancers, or Single Ladies. Each saving circle operates for 12 months, earns interest, and accepts new members at any time. The system supports setting and modifying saving reminders, with periodic check-ins to encourage topping the circle's leaderboard. The leaderboard resets at each circle's end, fostering friendly competition among users.

*Note: Any alterations made by the admin to savings plans affect active users' ongoing saving plans. Each user creates and manages their own saving plans.

Loan System

Advanced loan system requires users to provide recent financial statements and guarantor information. Admins review this data to determine loan eligibility. Admins can establish loan plans, including suggested amounts, interest rates, failed interest, durations, and more. The platform effectively tracks pending loan applications, defaulters, and completed loans. An integrated loan calculator offers users a preview of their repayment plan upon loan approval. If enabled by admin, users can repay loans in installments. Users cannot apply for a loan if a pending application exists. Admins can view detailed statistics, including earnings from loan repayments. To avoid increased interest rates, the system sends reminders to clients two days before repayment deadlines. Each loan application includes bank account details. Modifying loan plans doesn't impact ongoing applications.

Buy Now Pay Later

Facilitates purchasing products, like an iPhone 14 Pro Max, with options to pay in installments or upfront. Customer address information is shared for convenient shipping. All loan application features apply here.

Mutual Funds/Equity

Mutual funds pool investor funds for diversified investments in stocks, real estate, and more. Admins can control dividends and unit sales. Claim durations prevent immediate unit selling. Admins define unit limits and facilitate dividends with ease. Admins maintain unit price history, linking to investment details, fund managers, fees, and reminders.

Project Investment

Distinct from mutual funds, Project Investment focuses on interest accrued from unit value. Admins create projects with start and end dates, disbursing profits to investors post-project. Email updates and progress reports are available.

Withdrawal

Supports bank payouts and alternative withdrawal methods. Admins configure these in settings. Bank withdrawal settings include account validation, withdrawal limits, and fees. Crypto and PayPal withdrawals can be added with prerequisites and fees.

P2P Transfer

Users transfer funds within Platform. Admins manage P2P in settings, adjusting limits and fees.

Cron Job Updates

- Pending payment gateway deposits

- Project investment returns

- Savings returns

- Emergency savings reminders

- Unit addition reminders

- Loan repayment reminders

- Loan defaulter checks

- Expired ID checks

All Features

- Multi-language support

- Diverse withdrawal options

- Login OTP

- Advanced KYC with personal, document, and selfie uploads

- Bank account addition

- Social logins

- Multiple payment gateways

- Payout and deposit management

- Beneficiary system

- Varied saving schemes

- Loan system

- Buy Now Pay Later

- Staff management

- Financial statements and loan guarantor uploads

- Investment plan management

- 2FA authentication

- Phone and email verification

- Recaptcha

- Next of Kin details

- Referral system with investment waiver fee

- Exceptional user experience

- Help center

- Blog system

- Live chat support

- Analytics integration

- Multiple email templates

- Job queueing for email sending

- Intuitive interface controls

- Social links integration

- Terms and privacy policy

- Twilio SMS integration

- Admin audit logs

- Enhanced promotion system

- Scalability-focused architecture

Demo details: Frontend: https://whitelabel.justwallet.com/bespoke

Admin Access: https://whitelabel.justwallet.com/bespoke/admin

Admin Login: Username: admin || Password: 1234 User Access:

https://whitelabel.justwallet.com/bespoke/login

User Login:Email: [email protected] || Password: junejune

Created: 2025/07/29

Framework: Laravel

Admin URL: https://whitelabel.justwallet.com/bespoke/admin

Admin username: admin

Admin password: 1234

Create an account for full experience